Listening to brokers

Earlier this year we published a feature, Commercial Brokers: Pick Your Poison, which highlighted the plight of commercial insurance brokers in Canada. Our verdict was that brokers are faced with only two options when deciding how to go to market – and both of them are extremely painful.

They can opt to use insurer portals, which can speed up the process in some instances, but are full of shortcomings when it comes to choice, flexibility, breadth and data.

Alternatively, brokers can package and send applications by e-mail to underwriters, and get caught in a black hole of waiting, uncertainty and delays.

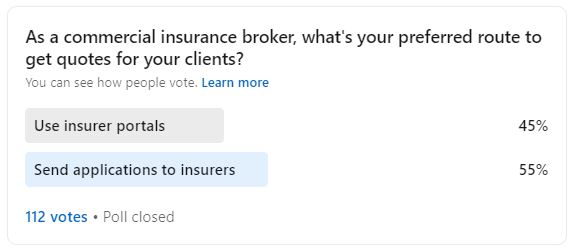

We thought it would be interesting to see what brokers thought, so we created a quick and simple LinkedIn survey asking brokers one question: “As a commercial insurance broker, what’s your preferred route to get quotes for your clients?”.

Survey results

Based on 112 responses, less than half of the respondents indicated a preference for insurer portals with the majority favoring the tried and trusted method of sending applications to insurers.

It’s also interesting to note that with a 45% support group, insurers may feel encouraged to continue with portal development strategies. Even at 45%, this represents a substantial amount of brokers.

"None of the above"

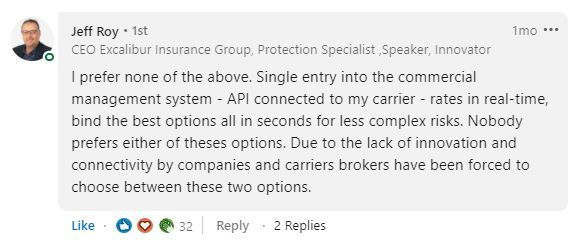

Sometimes, the truth is buried in the detail. In this case, the various comments posted alongside our survey were very illustrative of brokers’ real opinions.

One comment in particular stood out from prominent digital broker Jeff Roy, CEO of Excalibur Insurance Group with a lot of engagement from other LinkedIn members.

Jeff rightly pointed out one major flaw in our survey, in that many insurance brokers will not want to be forced to choose between two poor options. We interpret here that votes for either portals or sending applications to insurers should perhaps not be construed as support for either model, but merely a grudging acceptance of current realities.

Jeff clearly refused to play ball, voting “none of the above”. He stated that “nobody prefers either of these options” and outlined a vision for single entry into a commercial management system, with rates in real-time and options in seconds or less.

For what it’s worth, we hear you Jeff! A solution has long been needed so Canadian brokers will no longer have to face this lose : lose decision every time they need to go to market. Quotey has arrived.

Leave a Reply