Old School Rules!

Sometimes (well, lots of the time if we’re honest with ourselves) your client doesn’t fit the multitude of insurer and MGA portals out there. Even in 2023, there are multiple instances every day where the only viable way to help your client is to prepare a submission and send it to underwriters.

Over the last year, we’ve asked Canadian brokers from coast to coast how they ‘go to market’.

There were a few interesting strategies out there including various Excel or Word marketing sheets, and sometimes elaborate email folder structures come into play to track various insurer in-goings and outgoings.

Any guesses as to the overwhelming methodology used by brokers to track and manage their marketing process?

If you guessed pen and paper then you’re correct! That’s right, the majority of brokers we talked to use a notebook, pad or some form of printed marketing sheet to jot down notes of their clients and which insurers they were sent to. They add updates as and when they receive them.

In a similar vein, brokers typically use the same strategies for maintaining their contact list of insurers. Many are now using shared Excel or Word documents across the brokerage and updating them whenever an insurer adds or changes a contact. Some brokers maintain their own personal contact lists.

It became abundantly clear from our discussions that brokers wanted a solution which helps them with their ‘go to market’ process. So, we built a Digital Marketing Hub into Quotey.

What is a Digital Marketing Hub?

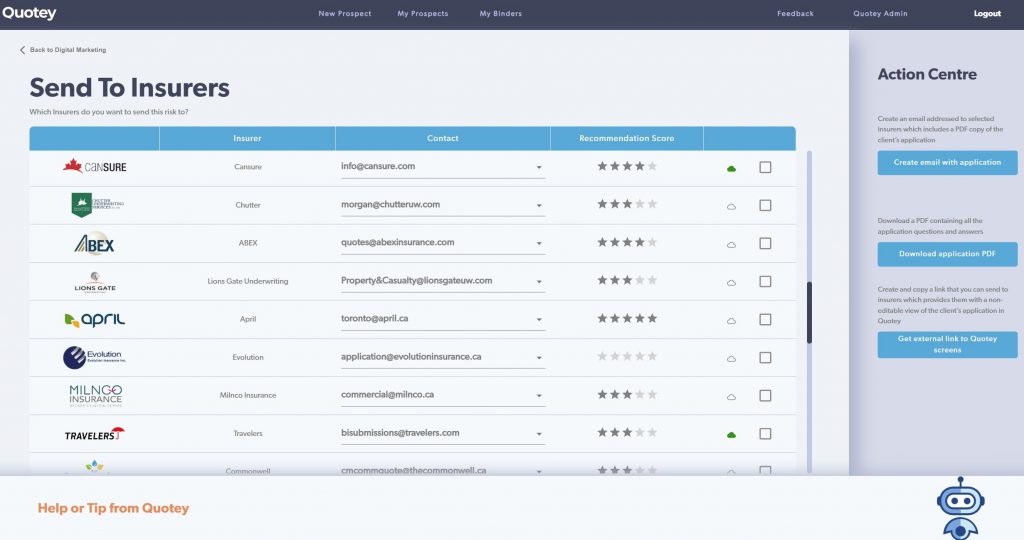

The Digital Marketing Hub is a key part of Quotey’s new business solution. When you complete one of the many hundreds of Quotey Smart Apps and click on ‘go to market’ you’re automatically taken to the Digital Marketing Hub.

From there, you have a range of options:

- Select your favorite insurers and send a comprehensive submission to them at the click of a button

- Manage all your insurer contacts and keep them updated whenever they change. Your entire team will see your preferred contacts per insurer

- Track details of which insurers have been sent the submission

- Update insurer responses whenever you receive them, including the potential to add full details of any quotes received

- Compare and share details of your marketing activity with your client at the click of a button

In the current climate where it’s becoming tougher and tougher to find the right insurer for your client, we hope that the Digital Marketing Hub is just one more way in which Quotey can take the pain out of your commercial lines processes.

To learn more and see a demo, click below and we’d be delighted to show you how it works.

Leave a Reply